Global box office and global total cinema revenue will surpass pre-COVID-19 pandemic levels in 2026, but admissions won’t do so over the next five years. Global subscriptions to streaming services will post a 5.6 percent compound annual growth rate (CAGR) between 2023 and 2028, outpacing a compound annual gain in streaming revenue of just 4 percent. And advertising revenue will top the $1 trillion milestone in 2026 and be the fastest-growing of the three core revenue categories over the next five years.

Those are just some of the predictions contained in consulting and accounting firm PwC’s annual “Global Entertainment & Media Outlook,” published late on July 15.

The annual forecast, which covers 13 sectors across 53 countries and territories, notes that total revenue increased 5 percent in 2023 to $2.8 trillion, outpacing overall economic growth “despite economic headwinds, technological disruption, and increased geographic and industry competition.”

The CAGR for the next five years is projected to slow to 3.9 percent though, adding $597 billion to the global revenue pie to boost it to $3.4 trillion. Highlighting “widespread uncertainty,” PwC emphasized that the name of the game in the industry to capture some of that revenue is business model reinvention, which has “evolved from a strategic option into an existential imperative,” the firm said.

When it comes to cinema revenue, the trends have been mixed. “Aided by a number of blockbuster releases in 2023, cinema saw a 30.4 percent year-on-year increase in spending at the box office,” PwC highlights.

But box office/theatrical revenue will top pre-pandemic levels in 2026, rather than 2025 as projected a year ago, according to the firm’s updated forecast. “This is primarily driven by a larger budget slate expected to drive more box office sales and more ad spend,” explains Bart Spiegel, global entertainment and media deals leader at PwC, to The Hollywood Reporter.

The firm sees the 2019 box office revenue of $38.55 billion nearly reached in 2025 with $37.68 billion before hitting $40.23 billion in 2026.

Global cinema revenue, helped by ticket price hikes and advertising growth, will continue to grow, but also see a one-year delay. “In last year’s report, we anticipated that pre-pandemic levels would be reached by 2025. However, this year’s report predicts that the return will occur in 2026, indicating a more pessimistic outlook,” shares Spiegel. “Some of this can be attributed to a stronger budget slate throughout the year 2026. It is worth noting that there has been movement over the years, as some major studios made announcements towards the end of 2023.”

PwC estimates that after $42.11 billion in global cinema revenue, 2025 will reach $41.34 billion before a further jump to nearly $44.00 billion in 2026.

The picture for cinema admissions is different. “Admissions are not expected to return to pre-pandemic levels throughout the forecast period. By 2028, the last year of our projections, admissions are projected to fall short by 1.5 billion compared to pre-pandemic levels,” explains Spiegel. That means around 6.45 billion admissions forecast for 2028, compared with 7.92 billion in 2019.

In North America, admissions are also not anticipated to reach pre-pandemic levels during the forecast period ending in 2028 when PwC forecasts 953 million admissions, which Spiegel calls “a significant decrease from 1.3 billion in 2019.” Factors contributing to this decline include “changes in consumer habits following the pandemic, the increasing popularity of streaming platforms, the impact of rising inflation, and audience fatigue with superhero movies,” he says.

In streaming, PwC diagnoses slowing revenue momentum amid a maturing business. “This lack in revenue growth is likely because consumers are becoming overwhelmed by the number of streaming service choices,” it explains. “Companies are responding by offering lower subscription fees in exchange for showing ads.”

Streaming usage and consumer uptake are rising, “albeit at a lower rate than in recent years as service providers face increased competition and challenges in getting consumers to pay more for digital goods and services,” the firm’s report mentions. “Global subscriptions to over-the-top (OTT) video services will rise to 2.1 billion in 2028 from 1.6 billion in 2023 – representing a 5 percent CAGR. Global average revenue per [streaming] video subscription is barely expected to grow, rising from $65.21 in 2023 to $67.66 in 2028.”

That explains recent strategy shifts at streaming services. “This plateauing effect is pushing leading streamers to reshape their business models and find new revenues beyond subscriptions, including the introduction of ad-based variants (reduced subscription fees with ad-filled content), cracking down on password-sharing, introduction of live sports, and industry consolidation,” says PwC. “In developed markets, this consolidation is taking the form of bundling subscription service providers.”

Cord-cutting will continue to impact the industry over the coming years, according to the Global Outlook report. “We anticipate ongoing declines in the linear ecosystem as more users transition to digital offerings,” shares Spiegel. “While some major legacy media companies now offer digital options, they all still face challenges in reducing churn, managing the rising costs of content (especially sports rights), and delivering a compelling value proposition to their subscribers.”

All this also means that advertising is becoming a bigger part of the streaming revenue mix. The result: “In four years, advertising will make up almost 28 percent of all the money that streaming services make – a major increase from the 20 percent it made in 2023.”

Speaking of advertising: Global ad revenue is expected to grow at a 6.7 percent CAGR through 2028, ahead of the other two broad sector segments. Connectivity will post a CAGR of 2.9 percent, while consumer spending will only reach a 2.2 percent CAGR.

Total advertising revenue will hit $1 trillion in 2026, “while 2028 revenue will hit double the revenue of 2020,” the accounting firm predicts and highlights: “Advertising is projected to account for 55 percent of the total entertainment and media industry’s growth over the coming five years.” Internet advertising is the largest and “one of the fastest-growing components” of the ad pie. Notes the PwC report: “It grew 10.1 percent in 2023, adding $52.5 billion in new revenues, and is projected to rise at a 9.5 percent CAGR through 2028 when it will account for 77.1 percent of total ad spending.”

What is behind the growing importance of ad revenue? “Advertisers are now willing to invest more in reaching consumers through different platforms, including phones, games, and e-commerce sites,” Spiegel tells THR. “The growing significance of advertising in the entertainment and media industry can be attributed to factors such as the ability to monetize data, the closer relationship between product discovery and purchase, and the influence of global privacy regulations.”

Questioned about the impact of higher consumer prices on the media industry, the expert notes: “Consumer spending has been affected by inflation, prompting media companies to respond by offering more ad-friendly or ad-supported options at a lower price point.”

Meanwhile, gaming, including the e-sports business, has continued being what PwC describes as “one of the fastest-growing large sectors in the entertainment and media universe, with total revenue hitting $227.6 billion in 2023, up 4.6 percent.” Gaming revenue is on track to top $300 billion in 2027, almost double its level in 2019, the firm highlights.

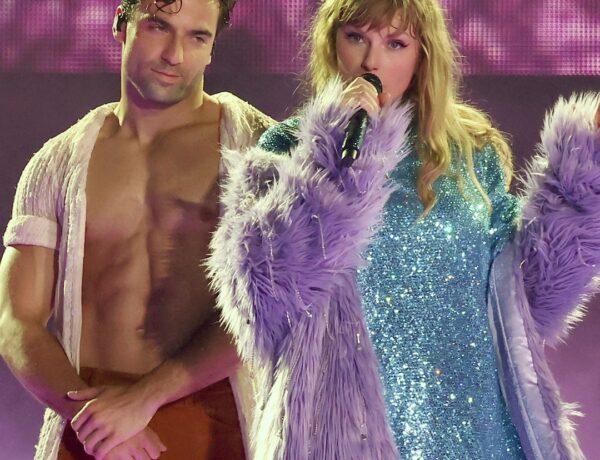

All those Taylor Swift fans, old and new, streaming to stadiums have also been a key growth engine. Notes PwC: “Driven by large events, such as musician world tours, live music revenues rose 26 percent and accounted for more than half of the overall music market.”

Of course, AI also gets attention in the latest PwC report. Summarizes the company: “The global entertainment and media industry looks to generative AI to drive new revenue streams and transform

business models.”

After all: “Shifts in consumer preferences, and uncertainty around the continued impact of digital transformation and new and emerging technology, such as generative AI, are inspiring a wave of business model reinvention. If market players are to gain their share of the growing revenue pools we identify, they will have to reimagine how their company creates, delivers, and captures value, leveraging the growth of advertising while also harnessing the powerful opportunity presented by AI.”

There are, of course, also risks and discussions to be had. “Having exploded onto the scene in the past couple of years, generative AI brings major implications — including both opportunities and challenges,” PwC notes in its Global Outlook report. “The U.S. cut of PwC’s most recent CEO Survey shows that nearly half of U.S. CEOs see GenAI boosting profits this year, with 61 percent expecting it to improve the quality of their products and services.”

The labor talks of the past year made AI a focus topic though. “The need to control the use of AI tools and AI-generated content — and to avoid undercutting creators’ rights and payments — were key factors in the 2023 Hollywood writers’ strike, and in the subsequent deal struck with the Writers Guild of America,” notes the PwC report. “Going forward, the speed at which high-quality content can be produced will continue to increase as the related costs decline. The open question remains precisely how GenAI will translate into higher revenues and help companies accelerate their pursuit of revenue pools.”

One high-potential area is in the advertising space, according to the Global Outlook. “GenAI is increasingly being integrated into content creation and advertising tools,” it notes. “Here its application has tended to focus initially on extracting small pieces of information and generating summaries in subsectors, such as sports media,” it highlights before outlining more opportunity ahead: “If GenAI can be harnessed to offer new experiences and create new revenue streams, the growth potential is even greater.”