Have you ever stared at a “Connect Wallet” button and felt a wave of anxiety? You’re not the only one. I remember the first time I tried to move Bitcoin in 2017—I triple-checked the address so many times my eyes watered. In January 2026, the stakes are even higher, with over $2 trillion in cryptocurrencies moving daily and sophisticated threats like “address poisoning” targeting new users.

Finding the Easiest Hosted Crypto Wallet for Beginners in 2026 isn’t just about picking a popular app; it’s about finding a partner that watches your back. I’ve spent the last few years testing everything from the simplest mobile apps to complex hardware setups, and I’ve learned that the “best” wallet is the one you can use without sweating bullets.

So, grab a cup of coffee, and let’s go through the safest, simplest options together. I’ll show you exactly which tools effectively balance ease of use with military-grade security.

Key Takeaways

- Custodial vs. Self-Custody Clarity: “Hosted” wallets like Coinbase (Exchange) manage keys for you and offer FDIC insurance on USD deposits up to $250,000, while apps like Trust Wallet give you full control but require you to safeguard your own backup.

- Security Innovations for 2026: Top contenders now include features like Zengo’s MPC (Multi-Party Computation), which splits your private key to prevent theft, and Trust Wallet’s Security Scanner, which alerts you to risky transactions in real-time.

- Fee Awareness: Binance.US leads with ultra-low trading fees (~0.1%), whereas Coinbase charges more for convenience unless you upgrade to their Coinbase One subscription for zero-fee trading.

- The “Super App” Trend: Wallets have evolved into “everything apps.” MetaMask now supports Bitcoin via “Snaps,” and Exodus integrates directly with Trezor hardware wallets for the best of both worlds.

- Expert Advice: Dr. Olivia Carter warns that while hosted wallets are convenient for daily trading, you should never store life-changing amounts on them; always move long-term savings to cold storage.

What is a Hosted Crypto Wallet?

Think of a hosted crypto wallet like a bank account for your digital currency. Instead of burying gold bars in your backyard (which is what managing your own private keys feels like), you trust a secure facility to guard them for you.

In this setup, third-party services like Coinbase or Binance manage the complex cryptography. They store your private keys—the digital passwords needed to access your funds—on their secure servers, often keeping up to 98% of customer assets in offline “cold storage” bunkers to prevent hacking.

“A hosted wallet connects your real-world identity to your digital assets, allowing you to recover your funds with a simple password reset if you lose your phone.”

For US users, this offers a familiar safety net. Many top US-based exchanges provide FDIC insurance for your USD cash balances up to $250,000, similar to a regular bank. While this insurance doesn’t cover the crypto itself, it adds a layer of legitimacy that decentralized apps can’t match.

These platforms also simplify the technical hurdles. You can buy Bitcoin using connected methods like PayPal, Venmo, or a debit card directly within the app. Features like multi-chain support allow you to hold Ethereum, Solana, and Bitcoin all in one dashboard without needing to understand the underlying networks.

Why Hosted Wallets are Ideal for Beginners

When you are just starting, the fear of “messing up” is real. Hosted wallets act as training wheels, handling the dangerous mechanics so you can focus on learning the market.

Ease of Use

The biggest barrier to crypto is often the user interface. Good hosted wallets look and feel just like the banking apps you already use. For example, the Coinbase app uses a “Simple Trade” mode by default, which hides complex charts and order books, showing you just a clear “Buy” or “Sell” button.

Modern wallets also integrate familiar payment rails. In the US, you can now link your PayPal account to instantly fund your crypto purchases on major platforms. This means you can go from zero to owning Bitcoin in about three minutes, skipping the confusing process of copying alphanumeric wallet addresses.

Most of these platforms also offer integrated buy and sell options. This saves you from having to use a separate “exchange” website and then transfer funds to your wallet—a step where many beginners accidentally lose money.

No Need for Private Key Management

In a self-custody wallet, if you lose your 12-word recovery phrase, your money is gone forever. There is no customer support to call. Hosted wallets solve this terrifying problem.

With a custodial service, you log in with an email and password. If you forget your credentials, you can use email recovery or verify your identity with a photo of your driver’s license to regain access. This is known as “Social Recovery” in some circles, and it’s a lifesaver for anyone prone to losing sticky notes.

For those who want extra security without the hassle, Zengo uses a technology called MPC (Multi-Party Computation). It splits your key between your device and their server, so there is no single “secret phrase” for you to lose or for a hacker to steal.

Built-in Security Features

Hosted wallets deploy enterprise-level security that an individual simply cannot match on a home laptop. A standard feature in 2026 is mandatory Two-Factor Authentication (2FA), but the best platforms now support hardware keys like YubiKey for unphishable protection.

Many wallets also display a CERTIK SKYNET SCORE, which rates their code security. For instance, Trust Wallet boasts a score of over 90, reflecting its rigorous audit history.

Another rising trend is “Transaction Simulation.” Before you confirm a transfer, wallets like MetaMask and Trust Wallet now simulate the transaction to show you exactly what will happen. If the contract looks malicious or tries to drain your wallet, the app will flash a red warning before you can click “Confirm.”

Key Features to Look for in a Beginner-Friendly Hosted Wallet

Not all wallets are created equal. To find the right fit for your needs, you should look for these specific tools that make life easier and safer.

User-Friendly Interface

A cluttered screen is a beginner’s worst enemy. Look for an app that supports “Dark Mode” and offers a clean dashboard. Exodus is famous for this—it visualizes your portfolio as a colorful pie chart, making it instantly clear how your assets are distributed.

You also want a wallet that speaks your language. The Phantom wallet, originally for Solana but now multi-chain, has a 4.8-star rating largely because it automatically detects spam NFTs and hides them from your view, keeping your interface clean and safe.

Multi-Currency Support

You don’t want five different apps for five different coins. A good beginner wallet acts as a universal adapter. Trust Wallet supports over 100 blockchains, meaning you can store Bitcoin, Ethereum, and obscure meme coins all in one place.

For more advanced users, MetaMask recently launched “Snaps,” which are plugin modules that allow you to manage non-Ethereum assets like Bitcoin directly within the MetaMask interface. This removes the need to switch between different apps just to check your Bitcoin balance.

Integrated Buy and Sell Options

The ability to convert cash to crypto within the app is critical. Top wallets integrate with “on-ramp” providers like MoonPay, Banxa, or Sardine. These services scan for the best exchange rate across multiple providers, ensuring you don’t overpay when buying with a card.

For US users, Coinbase and Robinhood offer the smoothest experience here. They allow you to link a bank account via Plaid, enabling instant deposits that are immediately available for trading, even before the funds clear your bank.

Mobile and Desktop Compatibility

Your wallet should move with you. Exodus offers excellent syncing between its mobile app and desktop software. You can start a transaction on your computer and finish it on your phone with a quick QR code scan.

“True cross-platform compatibility means your transaction history and address book are identical whether you are on your iPhone or your Windows laptop.”

MetaMask also syncs seamlessly across its browser extension and mobile app. This is crucial for users who might find a new decentralized finance (DeFi) opportunity on Twitter while on their commute and want to act on it immediately.

Low Fees

Fees can eat your profits alive if you aren’t careful. Network fees (gas) go to miners, but platform fees go to the wallet provider. Binance.US is a favorite for cost-conscious traders because its maker/taker fees start at around 0.1%, drastically lower than the industry average.

Beware of “convenience fees” on credit card buys, which can hit 3.99% or higher. A pro-tip for 2026 is to look for subscription models; Coinbase One members pay $29.99/month but get zero trading fees on hundreds of assets, which pays for itself if you trade frequently.

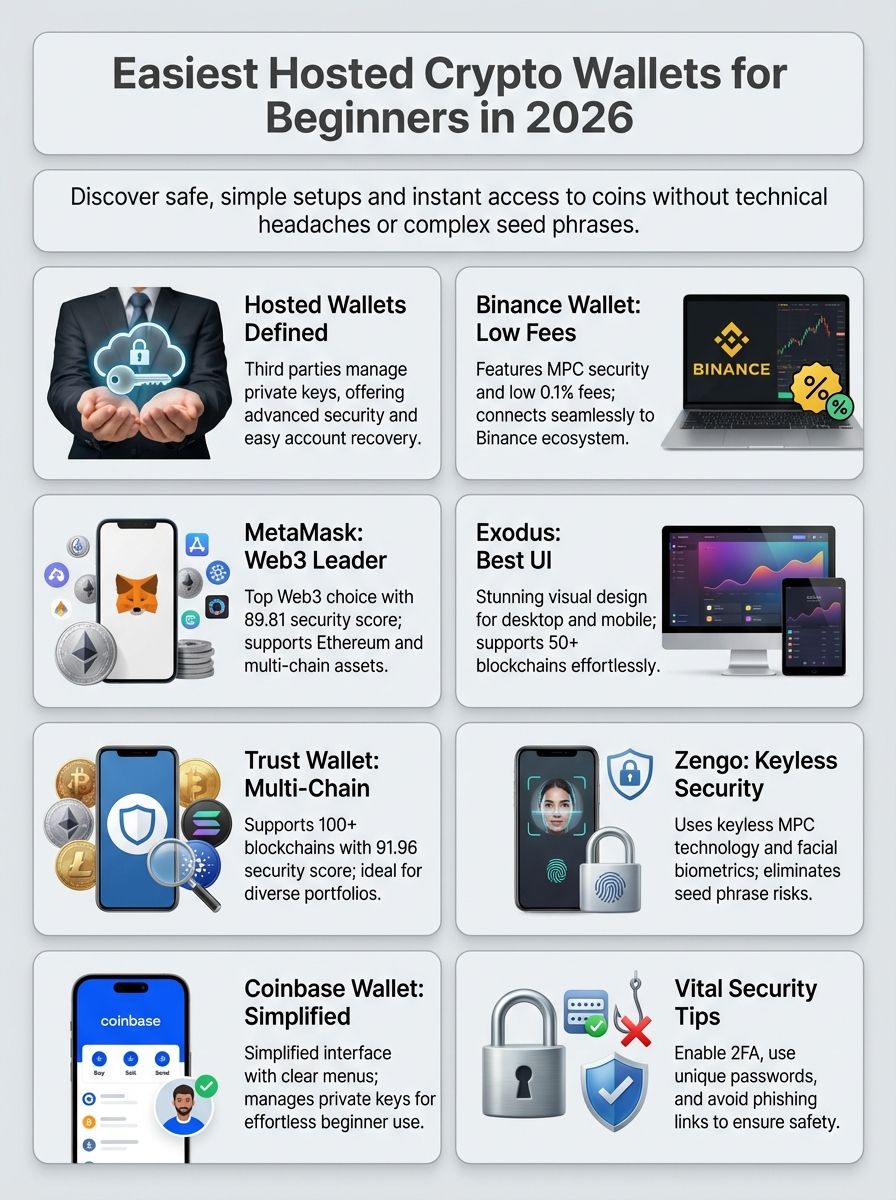

Top Hosted Crypto Wallets for Beginners in 2026

Let’s look at the specific apps that are winning the market right now. I’ve categorized them so you can see which one fits your specific style.

MetaMask: Best for Web3 Beginners

MetaMask is the gateway to the decentralized web. While technically a “self-custody” wallet (you hold the keys), it is the most widely supported tool for accessing Web3 apps like Uniswap or OpenSea.

The game-changer for 2026 is MetaMask Snaps. These are third-party plugins that you can install to add new features. For example, you can install a “Bitcoin Snap” to manage BTC, or a “Security Snap” that gives you detailed warnings about phishing sites. This transforms MetaMask from a simple Ethereum wallet into a customizable super-app.

Trust Wallet: Great for Multi-Chain Support

Trust Wallet lives up to its name with a massive user base of over 115 million people. Its superpower is the Security Scanner, a built-in feature that assigns a risk level to every transaction before you sign it. If you try to send money to a known scammer’s address, the app blocks you.

It supports a staggering number of assets—over 10 million distinct tokens across 100+ blockchains. If you are the type of investor who likes to hunt for “hidden gems” on new networks, this is the wallet for you. Plus, it enables staking for cardano and solana directly in the app, letting you earn passive income (about 3-5% APY) with two taps.

Coinbase Wallet: Simplified and Secure

Coinbase offers two distinct products: the main Exchange App (Custodial) and the Coinbase Wallet (Self-Custody). For absolute beginners, the Exchange App is the easiest starting point. It offers a “Vault” feature, which requires a 48-hour waiting period and approval from two email addresses to withdraw funds—perfect for forced savings and security.

For those using the Exchange, the Coinbase One subscription offers up to $250,000 in account protection against unauthorized access. This level of insurance is practically unheard of in the crypto space and provides immense peace of mind for US residents.

Binance Wallet: Best for Beginners in the Binance Ecosystem

For users who want access to a massive variety of coins, Binance is a powerhouse. The Binance Web3 Wallet is integrated directly into their main app, using MPC technology to remove the need for seed phrases. You can recover your wallet using cloud backups and a password.

Note for US Users: You will be using Binance.US, which has a slightly smaller selection of coins than the global version due to regulations, but it still offers some of the lowest trading fees in the country. It’s an excellent choice if your primary goal is to trade actively rather than just hold.

Exodus: User-Friendly with Desktop and Mobile Support

Exodus is arguably the most beautiful wallet on this list. It is designed for visual learners, with lush charts and a clean, jargon-free interface. It updates every two weeks, ensuring you always have support for the latest major coin upgrades.

Its standout feature is the deep integration with Trezor hardware wallets. You can plug your Trezor into your computer and view your cold storage funds directly inside the beautiful Exodus interface. This bridges the gap between ease-of-use and maximum security perfectly.

Zengo: Enhanced Safety for Web3 Users

Zengo is unique because it has no seed phrase to lose. It uses MPC (Multi-Party Computation) to split your security key: one part is on your phone, and the other is encrypted on their server. Even if Zengo’s servers are hacked, they can’t access your funds without your phone.

They also offer a feature called “Legacy Transfer.” This allows you to set up a trusted contact who can access your funds if you are inactive for a set period (like 3, 6, or 12 months). It’s a smart solution to the problem of “what happens to my crypto if something happens to me?”

Comparing the Best Hosted Wallets

Here is a quick snapshot of how these wallets stack up in terms of real-world features and safety ratings.

Security Features

Look closely at the “Recovery Method” column—this determines how easily you can get back into your account if disaster strikes.

| Wallet | Security Score (Certik/Audits) | Recovery Method | Best Security Feature |

|---|---|---|---|

| MetaMask | 89.81 (AA) | 12-word Seed Phrase | Snaps (Add-on security modules) |

| Trust Wallet | 91.96 (AA) | 12-word Seed Phrase or Cloud Backup | Security Scanner (Real-time risk alerts) |

| Binance Wallet | 91.59 (AA) | Email + Password (MPC) | MPC Keyless Recovery |

| Exodus | 85.40 (A) | 12-word Seed Phrase | Trezor Hardware Integration |

| Zengo | 85.19 (A) | 3D FaceLock (Biometric) | Legacy Transfer (Inheritance planning) |

| Coinbase App | 84.84 (A) | ID Verification (Custodial) | $250k Account Protection (via Coinbase One) |

Supported Cryptocurrencies

The “number of coins” matters less than “which coins.” Make sure your wallet supports the specific assets you want to buy.

| Wallet | Core Networks | NFT Support | Unique Fact |

|---|---|---|---|

| Trust Wallet | Bitcoin, Ethereum, Solana, +100 others | Yes (View & Send) | Supports 10M+ tokens including meme coins |

| Binance Wallet | BNB Chain, Ethereum, Bitcoin | Yes | Cheapest swaps within the Binance ecosystem |

| MetaMask | Ethereum, Base, Polygon, Arbitrum | Yes | Can support Bitcoin via third-party Snaps |

| Exodus | Bitcoin, Solana, Ethereum, Monero | Yes | Excellent support for privacy coins like Monero |

| Coinbase Wallet | Ethereum, Base, Solana, Bitcoin | Yes | Best integration with Base (L2) network |

Fee Structure

Understanding where your money goes is the first step to keeping it.

| Wallet | Trading/Swap Fee | Network Fee (Gas) | Subscription Option |

|---|---|---|---|

| Binance.US | ~0.10% | Standard | None |

| MetaMask | 0.875% service fee | Standard + Gas | None |

| Trust Wallet | Varies by provider (MoonPay/Simplex) | Standard | None |

| Coinbase | Variable (can be high for small buys) | Standard | Coinbase One ($29.99/mo for $0 fees) |

| Zengo | Processing fee on buys | Standard | Zengo Pro ($20/mo for premium security) |

How to Set Up a Hosted Crypto Wallet

Ready to get started? I’ll walk you through the setup for a typical US user. It’s easier than opening a bank account.

Step-by-Step Guide for Beginners

- Download the Official App: Go directly to the website (like coinbase.com or exodus.com) to find the link. Never search for “wallet” in the app store without verifying the developer name, as fake “lookalike” apps are common.

- Create Your Account: For custodial wallets like Coinbase, you’ll enter your email and create a password. For self-custody apps like Trust Wallet, you’ll be shown a 12-word seed phrase.

- Write It Down (Crucial): If you get a seed phrase, write it on paper. Do not screenshot it. Do not save it in a text file labeled “Crypto.” Ink on paper is unhackable.

- Verify Identity (KYC): US regulations require “Know Your Customer” checks. Have your driver’s license or passport ready. You’ll snap a photo of the ID and a selfie. This usually gets approved in under 5 minutes.

- Link a Funding Method: Connect your bank via Plaid or add a debit card. Debit cards are instant but have higher fees; bank transfers take 1-3 days but are cheaper.

- Enable Security: Immediately go to settings and turn on 2FA (Two-Factor Authentication). Use an authenticator app like Google Authenticator, not SMS, to avoid SIM-swap attacks.

Verifying Your Wallet

Verification can be annoying, but it protects you. Platforms use tools like Persona or Onfido to verify your ID instantly.

If you are stuck in “Verification Pending,” check your email. Often, it’s a simple issue like a blurry photo or a glare on your ID card. US users might also need to provide the last four digits of their SSN to comply with tax reporting laws (specifically Form 1099-DA coming in future tax years).

Backing Up Wallet Recovery Options

If you are using a “Cloud Backup” feature (available on Trust Wallet, Coinbase Wallet, and iCloud), make sure your cloud account itself is secure.

“A cloud backup is convenient, but if a hacker gets into your iCloud, they get into your crypto. I highly recommend using a unique, strong password for your Apple ID or Google account if you enable this feature.”

Tips for Choosing the Right Hosted Crypto Wallet

Still not sure? Use this simple checklist to narrow down your options based on what matters most to you.

Understand Your Needs

Are you a “set it and forget it” investor? Then a custodial wallet like Coinbase is perfect because they handle the security. You can just buy your Bitcoin and log out.

Are you curious about NFTs and DeFi? You will need a Web3-ready wallet like MetaMask or Coinbase Wallet (the standalone app). These allow you to connect to sites like OpenSea to buy digital art or Uniswap to trade tokens.

Check Platform Reputation

Reputation is everything. Look for a long track record. Coinbase has been public (Nasdaq: COIN) since 2021, meaning their financials are audited and transparent.

Avoid new wallets that promise “free Bitcoin” or unusually high interest rates. If a platform offers you 20% APY on stablecoins in 2026, run the other way. That is a classic sign of a Ponzi scheme or a high-risk lending platform.

Evaluate Support for Your Preferred Cryptocurrencies

Don’t assume every wallet supports every coin. For example, MetaMask natively supports Ethereum-based tokens. If you send Bitcoin directly to a MetaMask Ethereum address without using a “Snap” or a wrapper, you could lose it.

Check the wallet’s official support page. If you love the Solana ecosystem, Phantom or Exodus are far better choices than MetaMask.

Pros and Cons of Hosted Crypto Wallets

Let’s weigh the good against the bad so you can make an informed choice.

Benefits of Hosted Wallets

The biggest pro is the “Forgot Password” button. In the self-custody world, that button doesn’t exist. Hosted wallets give you a safety net that is invaluable for beginners.

They also simplify taxes. Major US platforms like Coinbase and Binance.US integrate with tax software like CoinTracker or Koinly. At the end of the year, you can generate a Form 8949 with one click, saving you hours of headache during tax season.

Limitations of Hosted Wallets

The downside is the lack of total control. During times of extreme market volatility, exchanges can sometimes pause withdrawals due to technical overload. If the site is down, you can’t move your money.

There is also the privacy aspect. Custodial wallets require full identity verification. If you believe in the anonymous ethos of crypto, a hosted wallet might feel too intrusive compared to a tool like Monero GUI Wallet.

Common Mistakes to Avoid with Hosted Wallets

I’ve seen smart people lose money in dumb ways. Here are the specific traps to watch out for right now.

The “Address Poisoning” Scam

This is a nasty trick that became rampant in 2024 and 2025. Scammers create a wallet address that has the same first and last 4 characters as yours.

They send you $0 worth of tokens. The goal? They hope that next time you want to send money to yourself, you’ll copy their address from your transaction history instead of your actual address. Always check every character of the address, or use the “Address Book” feature to whitelist your safe addresses.

Ignoring Backup and Recovery Options

Many users set up a wallet, skip the backup step thinking “I’ll do it later,” and then break their phone. “Later” often becomes “never.”

Make the backup your very first step. If you use Zengo, set up the secondary email and face scan immediately. If you use Trust Wallet, write down that phrase before you even deposit a dollar.

Falling for Phishing Scams

You might get an email that looks exactly like it’s from MetaMask or Coinbase, saying “Your wallet is suspended, click here to verify.”

Fact: No wallet provider will ever ask for your seed phrase in an email or a support chat. If anyone asks for those 12 words, they are trying to rob you. Bookmark the official URL and only log in by typing it yourself.

Wallet Security Best Practices for Beginners

You don’t need to be a cybersecurity expert, but you do need to follow these three rules.

Enabling Two-Factor Authentication

SMS (text message) 2FA is better than nothing, but it’s vulnerable to “SIM swapping,” where a hacker tricks your phone carrier into transferring your number to their SIM card.

Upgrade to an authenticator app like Google Authenticator or Authy. For the gold standard, buy a hardware key like a YubiKey ($50). It requires you to physically touch the USB key to authorize a login, making remote hacking almost impossible.

Using Strong and Unique Passwords

Use a password manager like 1Password or Bitwarden. Generate a random 20-character password for your crypto exchange login.

If you reuse your Netflix password for your Coinbase account, and Netflix gets hacked, your crypto is at risk. Keep your financial passwords strictly unique.

Crypto Wallet Trends for 2026

The technology is moving fast. Here is what is shaping the wallet landscape this year.

Increased Integration with Web3 and DeFi

Wallets are becoming browsers. Apps like Coinbase Wallet now have a “Browser” tab that lets you surf the decentralized web safely. You can earn yield on your USDC or swap tokens on Uniswap without leaving the app.

Advanced Security Enhancements

We are seeing a move away from seed phrases entirely. Smart Contract Wallets (using a standard called Account Abstraction or ERC-4337) allow features like “spending limits” (e.g., you can’t withdraw more than $1,000 a day) and “social recovery.” This makes crypto feel much more like modern fintech.

How to Transition from Hosted to Non-Custodial Wallets

Eventually, you might want to “graduate” to holding your own keys. Here is how to do it safely.

Exporting Your Assets Securely

To move from Coinbase to a hardware wallet like a Ledger or Trezor:

- Set up your hardware wallet and write down its seed phrase.

- Find the “Receive” button for the specific coin (e.g., Bitcoin) in your hardware wallet app (like Ledger Live).

- Copy that address.

- Go to your hosted wallet (Coinbase/Binance), click “Send,” and paste the address.

- Test first: Send a tiny amount ($10). Verify it arrives. Only then send the rest.

Conclusion

Choosing the right crypto wallet is the first step in your investment journey. For most beginners in 2026, a hosted or hybrid wallet like Coinbase or Zengo offers the perfect balance of safety and ease.

Dr. Olivia Carter, a Ph.D. in Computer Science from Stanford, emphasizes that while usability is key, security must never be compromised. She recommends that new users start with a platform that offers robust account recovery options and clear, transparent fees.

Remember, you don’t have to stick with one wallet forever. You might start with a simple app today and move to a hardware wallet next year as your portfolio grows. The most important thing is to start with a tool that makes you feel confident and in control.

So, take that first step. Download a reputable app, set up your security features, and welcome to the future of finance.

Read more cryptocurrency articles at ClichéMag.com

Images provided by Deposit Photos, BingAI, Adobe Stock, Unsplash, Pexels, Pixabay Freepik, & Creative Commons. Other images might be provided with permission by their respective copyright holders.