“I stop the world. World stop.”

At the very start of Black History Month, people woke up to Beyoncé announcing the Renaissance World Tour 2023.

The post Ally Financial Cuts Beyoncé Fan A Check After Viral Tweet Displaying His Savings For Renaissance Tour Tickets appeared first on AfroTech.

Since the announcement, social media users have been eager to secure tickets. However, they are concerned about Ticketmaster’s online booking process and the possibility of high ticket prices. concern.

BEYONCÉ TICKETS THE SAME DAY AS RENT DUE? ROC NATION, YOU WILL CRUMBLE pic.twitter.com/q2DekgLYrm

— DDOT. (@DDotOmen) February 1, 2023

Fortunately, for Shane Bernard, he followed the motto of “If you stay ready, you ain’t got to get ready.”

In the midst of the online chaos caused by the “Alien Superstar,” Bernard shared on Twitter how he prepared for the moment.

“I’ve been saving $20 a paycheck for Beyoncé tickets since 2018 after I saw her at Coachella,” he tweeted. “I knew this day would come.”

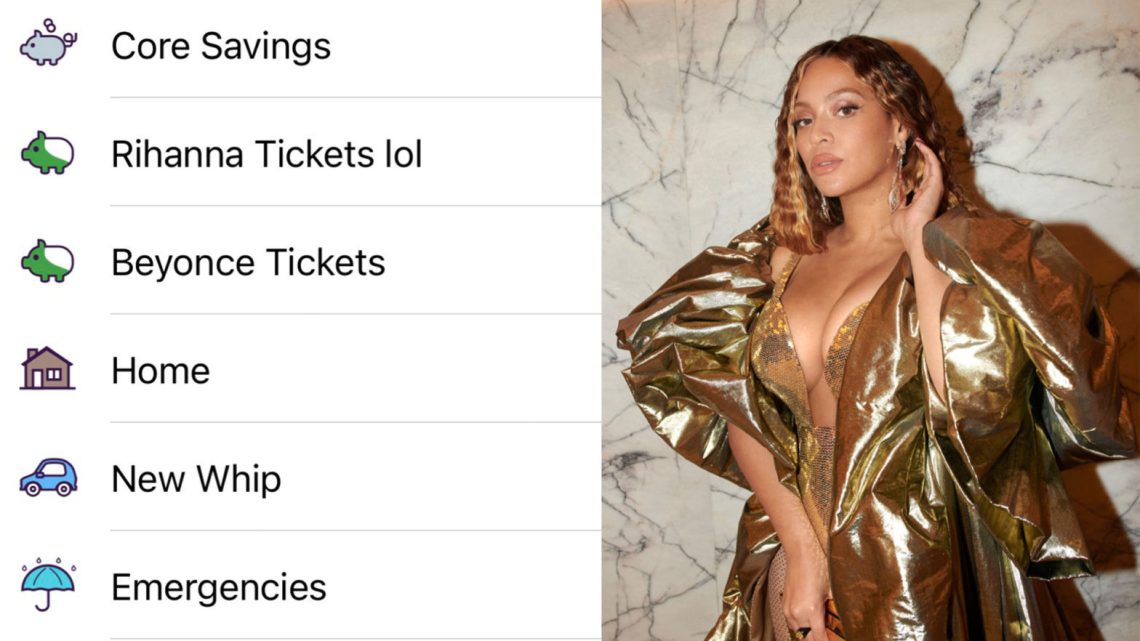

“Shoutout to @allyfinancial for their ‘saving buckets’ feature,” he added.

Ive been saving $20 a paycheck for Beyonce tickets since 2018 after I saw her at Coachella. I knew this day would come 😭 Shoutout to @allyfinancial for their “saving buckets” feature. pic.twitter.com/uj3Z1krfni

— shizzy shane (@shizzyshane215) February 1, 2023

Following Bernard sharing his strategic plan, the tweet went viral.

“I remember her for the first time at Coachella in 2018 on stage backed by a full HBCU marching band and dance team and saying to myself, ‘I will be at the next solo tour,’” Bernard told AfroTech. “From there, I created a bucket in my savings account specifically labeled ‘Beyoncé Tickets.’”

“That meant a percentage of each one of my paychecks would go directly into my savings account and out of that amount, $20 would go in a ‘Beyoncé [Tickets]’ bucket,” he further explained. “I then forgot about it over the course of the next five years until she announced her Renaissance World Tour. I initially created it because I was proud of myself for setting a goal, being disciplined in contributing toward it, and being prepared when the moment finally arrived.”

Bernard shared that he was surprised by how Twitter users were impressed by Ally’s savings buckets.

After the tweet, many publicly thanked him for putting them on to the feature and their gratitude and testimonials led to Ally’s own token of appreciation. According to Bernard, the bank holding company gave him “a hefty cash bonus” for being a loyal customer.

UPDATE: They cut the check 🚀🙌🏾 Happy Friday! pic.twitter.com/z8a9JB94Ir

— shizzy shane (@shizzyshane215) February 3, 2023

“This is exactly what our savings buckets were designed to do,” Ally Financial exclusively shared in a statement to AfroTech. “We’re thrilled that with the help of our tools and rates, Shane is on his way to the Beyoncé concert. We topped off his savings bucket with an extra $500 to help him level up his experience. Ally customers like Shane who use these tools are saving two times more than those who don’t. We hope Shane’s friends and followers take note! There’s nothing we love more than helping people reach their money goals.”

Based on what he’s learned from this experience, Bernard believes that there’s a need for more millennials and Gen Z to create savings accounts.

According to a 2020 survey by Insider and Morning Consult, 70 percent of millennials have a savings account for emergencies but 58 percent have a balance of under $5,000.

When looking at Gen Z, the State of Gen Z report showed that 54 percent said they were saving more since the pandemic, and 38 percent opened an online investment account.

From Bernard’s perspective, this moment also emphasizes the importance of having a quality user interface (UI) and user experience (UX) because while other banks may have savings accounts with exceptional interest rates, they are missing out on the fun, engaging features like Ally’s savings buckets to get young people motivated to build financial literacy.

“Creating a savings bucket gives you the chance to anticipate all the things you might need money for in the future and create specific buckets and goals for each one of those things,” he said. “It gives you more confidence when an unexpected cost arises to be able to say to yourself, ‘Bet, I already have money put away for that specific thing.’”

He added: “It makes you think twice about buying that designer jacket if you have to empty your ‘Beyoncé tickets bucket’ to fund it.”

Editorial note: Shane Bernard is an employee of Blavity, Inc.